Tweet Last month I was invited to participate in a Window Advisory Committee set up by the City of Phoenix Historic Preservation Commission. This may sound a bit esoteric to many of you, but some important issues were discussed that pertain to our historic neighborhoods. Here’s some background. We have 35 designated historic residential neighborhoods in the City of Phoenix. You can find out where they are here. These neighborhoods fall under Historic Preservation Overlay Zoning meaning that they are subject to Historic Preservation Design Guidelines. So if you live in one of those neighborhoods and you want to make…

Posts Tagged ‘energy efficiency’

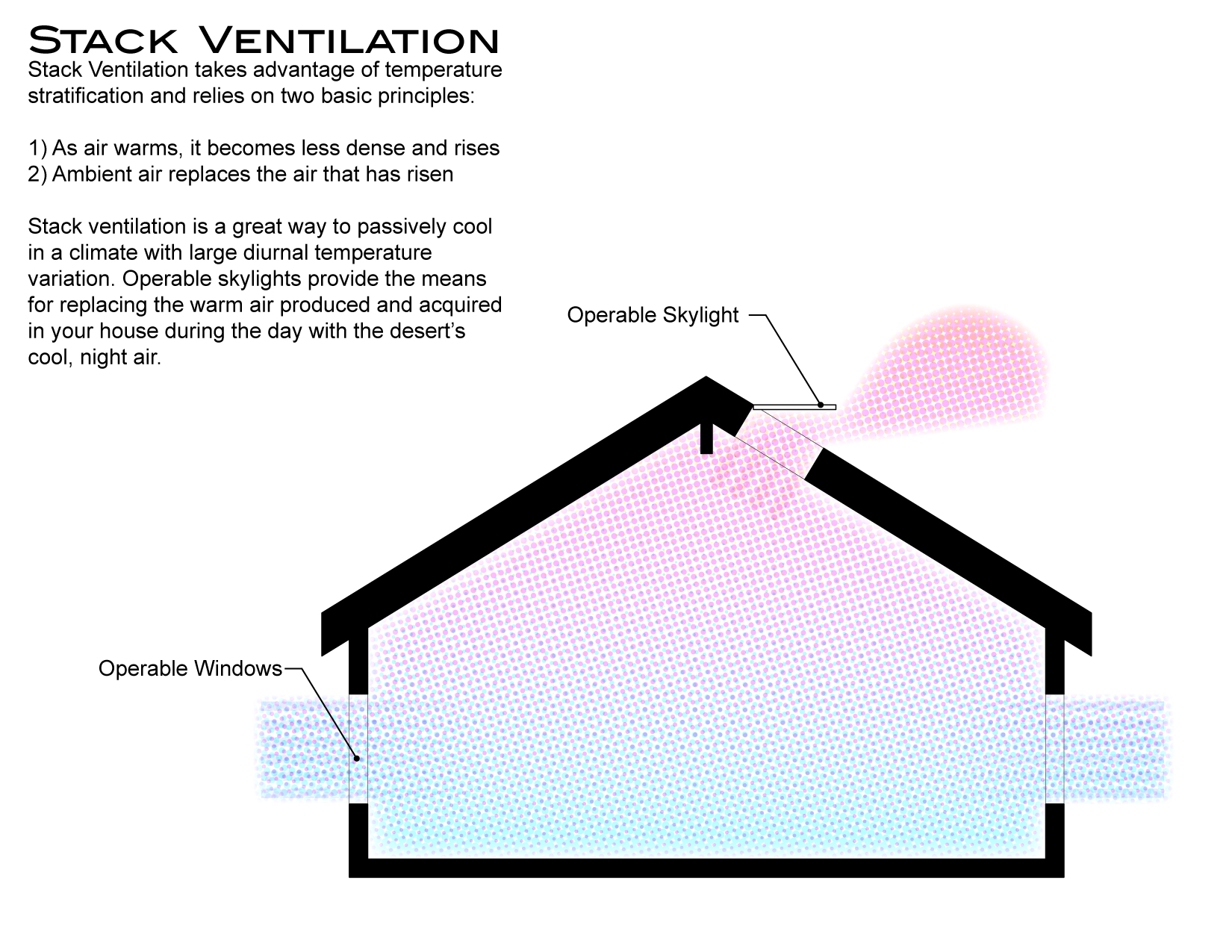

Tweet In this update: I. Claire walks us through the multiple considerations that go into every decision II.The idea of a triple bottom line approach III. An illustration of the stack ventilation concept created by Cavin I. Claire at the Site II. The Triple Bottom Line Approach Claire talked about the multiple benefits of keeping the existing wood roof structure of this 1950s house and actually exposing it as a vaulted ceiling in the remodel. We try to use the triple bottom line to make most of the decisions at Castaway House. In the case of the existing roof…

Tweet I met Jerry Ufnal while volunteering for the Greenbuild conference last year. He was the chair of the media and public relations committee for the local effort behind the national conference. Jerry is a leader in the green building community and is a wealth of information when it comes to energy efficiency. He was kind enough to write a guest post about his experience with a new trend in the green building industry, Home Energy Assessments: ____________________________________________________________________________ Mornings are still pleasant in Phoenix, so I leave the door open in my office for fresh air as I wait for…

Tweet Now that tax season is around the corner, here’s some information on what products are eligible for Tax credits under the ‘Stimulus Bill’ or The American Recovery and Reinvestment Act of 2009: Tax credits are available at 30% of the cost, up to $1,500 total, in 2009 & 2010 (ONLY for existing homes, NOT new construction, that are your “principal residence”) for: Windows and Doors (including Skylights) From June 1, 2009 – December 31, 2010 windows (and doors and skylights) must have a U-factor and Solar Heat Gain Coefficient (SHGC) less than or equal to 0.30. You do not…